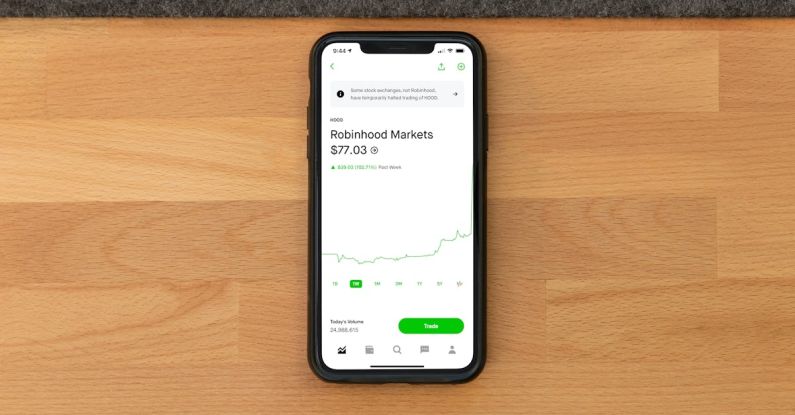

In the fast-paced world of cryptocurrency investments, market volatility plays a significant role in shaping the landscape for investors. The crypto market is known for its extreme fluctuations, with prices soaring to new heights one day and plummeting the next. Understanding how market volatility affects crypto investments is crucial for anyone looking to navigate this space successfully.

The Impact of Market Volatility on Crypto Investments

Market volatility in the cryptocurrency world refers to the rapid and unpredictable price changes that occur within a short period. Unlike traditional financial markets, the crypto market is highly volatile due to various factors such as regulatory developments, market sentiment, technological advancements, and macroeconomic trends. These fluctuations can have a profound impact on crypto investments, influencing decisions made by both retail and institutional investors.

Opportunities for Profit and Loss

One of the key ways market volatility affects crypto investments is by creating opportunities for profit and loss. Sharp price swings can result in significant gains for investors who time their trades correctly. On the other hand, it can lead to substantial losses for those who fail to anticipate market movements. The volatile nature of the crypto market means that investors must be prepared to weather sudden price changes and adjust their strategies accordingly.

Risk Management Strategies

Given the inherent risks associated with investing in cryptocurrencies, effective risk management strategies are essential for mitigating potential losses. Market volatility can expose investors to higher levels of risk, making it crucial to diversify their portfolios and set stop-loss orders to limit potential downside. By implementing risk management techniques, investors can protect their investments and navigate the turbulent waters of the crypto market more effectively.

Emotional Impact on Investors

Market volatility can also have a significant emotional impact on investors, leading to feelings of fear, greed, and uncertainty. The rapid price fluctuations in the crypto market can trigger emotional responses that may cloud judgment and lead to impulsive decision-making. It is essential for investors to remain calm and rational during periods of high volatility, as emotional trading can result in poor investment outcomes.

Long-Term Investment Perspective

Despite the short-term fluctuations caused by market volatility, taking a long-term investment perspective can help investors withstand the ups and downs of the crypto market. By focusing on the fundamentals of a project and its long-term potential, investors can avoid being swayed by short-term price movements and market noise. Adopting a patient and disciplined approach to investing in cryptocurrencies can help investors navigate market volatility and achieve their investment goals over time.

Adaptability and Flexibility

In a volatile market environment, adaptability and flexibility are key traits that can help investors thrive. Markets are constantly evolving, and being able to adjust investment strategies in response to changing market conditions is essential for success. By staying informed about market developments, monitoring price movements, and being open to adjusting their strategies, investors can position themselves to take advantage of opportunities and mitigate risks in the volatile crypto market.

Conclusion: Navigating Market Volatility in Crypto Investments

In conclusion, market volatility plays a significant role in shaping the landscape of crypto investments. Understanding how market volatility affects investments, seizing opportunities for profit, implementing risk management strategies, managing emotions, maintaining a long-term perspective, and being adaptable are essential components of navigating the volatile crypto market successfully. By staying informed, remaining disciplined, and being prepared to weather market fluctuations, investors can position themselves for success in the dynamic world of cryptocurrency investments.